When you buy ETF stocks, it's important to know that you should double-check your order details. Although ETF symbols may be similar, the meaning of an ETF can differ. So before you complete your order, double-check your spelling and order type. And remember that fat finger errors are common when you're first starting to trade. These are some tips to help you buy ETF stocks on margin.

Margin buying an ETF

Margin purchasing an ETF stock lets you purchase more shares than your available funds. The interest you pay for the borrowed money will reduce the profit you make. This strategy is risky. It's crucial to understand margin before you get started. It can save you money over time. These tips will help you to trade on margin. Here are some pros as well as cons to margin trading.

ETF trading fees

Fees and fund costs go hand in glove. ETFs can be cheaper than mutual funds, and they have lower operating expenses. Investors can thus keep more of what they earn. ETF traders typically pay less than mutual funds for their trading fees. Morningstar calculated the average expense ratio of U.S. ETFs. These are the key differences between mutual funds, ETFs. Which is better? Which has lower costs?

Margin buying an ETF for the long-term

For first-time investors, it's important to consider whether buying an ETF on margin is safe. ETF prices fluctuate constantly, so this type of investment needs to be monitored. Margin buying can lead to increased risks. Investors may have to pay interest charges. This could reduce profits or cause losses. Investors should understand the ETF's objectives, risks, and costs before using margin to purchase it.

Investing In An Index Fund

Investing in an index fund is an excellent way to invest without requiring you to actively manage your investments. Index funds track the performance and are an excellent investment option for people who don’t care about current market information. Because managers are not required to pick individual stocks, index funds tend to be less expensive than mutual funds. Because they have a low turnover rate, they can delay capital gains taxes. Although it is more risky to invest in index funds than mutual funds, it can still be beneficial in certain circumstances.

Investing in ETFs

One advantage of investing in ETFs is the variety of securities they offer. They can reduce the distributions of capital gains which can lower your tax bill. ETFs are subject to overvaluation relative to their underlying holdings. But this is rare and rarely significant. Here's how to avoid being overexposed when investing in ETFs:

Margin investing in an ETF

Margin investing in ETF stock requires high net gains. You cannot borrow more than the margin account interest because you are borrowing money. Margin trading can lead to you losing money. Investing on margin is an option for seasoned veterans, but novices should use caution. Trading on margin is similar to gambling. Margin trading is a popular way for professional money managers to increase their profit. But, it is not uncommon for rogue traders to lose their fortunes within minutes.

FAQ

Can I put my 401k into an investment?

401Ks can be a great investment vehicle. Unfortunately, not everyone can access them.

Most employers offer their employees one choice: either put their money into a traditional IRA or leave it in the company's plan.

This means that your employer will match the amount you invest.

If you take out your loan early, you will owe taxes as well as penalties.

Should I diversify or keep my portfolio the same?

Diversification is a key ingredient to investing success, according to many people.

In fact, many financial advisors will tell you to spread your risk across different asset classes so that no single type of security goes down too far.

However, this approach does not always work. You can actually lose more money if you spread your bets.

Imagine, for instance, that $10,000 is invested in stocks, commodities and bonds.

Consider a market plunge and each asset loses half its value.

There is still $3,500 remaining. However, if you kept everything together, you'd only have $1750.

In reality, your chances of losing twice as much as if all your eggs were into one basket are slim.

It is important to keep things simple. Don't take on more risks than you can handle.

Should I buy individual stocks, or mutual funds?

Mutual funds can be a great way for diversifying your portfolio.

They may not be suitable for everyone.

You should avoid investing in these investments if you don’t want to lose money quickly.

You should opt for individual stocks instead.

Individual stocks give you more control over your investments.

Additionally, it is possible to find low-cost online index funds. These allow you to track different markets without paying high fees.

How can I tell if I'm ready for retirement?

The first thing you should think about is how old you want to retire.

Is there a particular age you'd like?

Or, would you prefer to live your life to the fullest?

Once you have set a goal date, it is time to determine how much money you will need to live comfortably.

You will then need to calculate how much income is needed to sustain yourself until retirement.

Finally, calculate how much time you have until you run out.

What do I need to know about finance before I invest?

To make smart financial decisions, you don’t need to have any special knowledge.

All you need is common sense.

These are just a few tips to help avoid costly mistakes with your hard-earned dollars.

First, be careful with how much you borrow.

Don't fall into debt simply because you think you could make money.

Be sure to fully understand the risks associated with investments.

These include inflation and taxes.

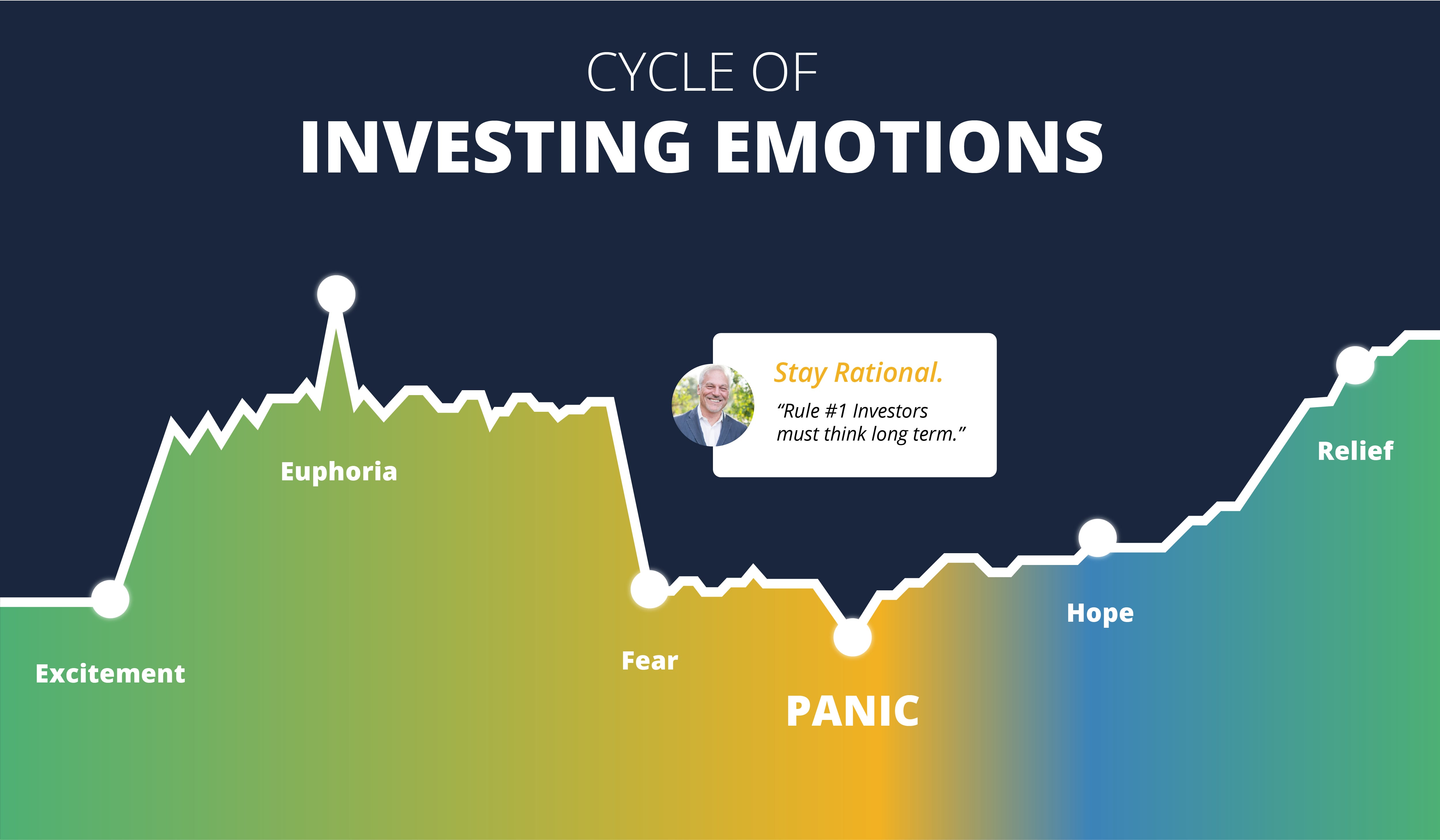

Finally, never let emotions cloud your judgment.

It's not gambling to invest. It takes discipline and skill to succeed at this.

These guidelines will guide you.

Statistics

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

- An important note to remember is that a bond may only net you a 3% return on your money over multiple years. (ruleoneinvesting.com)

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

- They charge a small fee for portfolio management, generally around 0.25% of your account balance. (nerdwallet.com)

External Links

How To

How to invest stocks

Investing can be one of the best ways to make some extra money. It is also one of best ways to make passive income. There are many ways to make passive income, as long as you have capital. It is up to you to know where to look, and what to do. The following article will teach you how to invest in the stock market.

Stocks represent shares of company ownership. There are two types of stocks; common stocks and preferred stocks. While preferred stocks can be traded publicly, common stocks can only be traded privately. The stock exchange allows public companies to trade their shares. The company's future prospects, earnings, and assets are the key factors in determining their price. Stocks are purchased by investors in order to generate profits. This is known as speculation.

There are three steps to buying stock. First, choose whether you want to purchase individual stocks or mutual funds. Second, choose the type of investment vehicle. Third, decide how much money to invest.

You can choose to buy individual stocks or mutual funds

When you are first starting out, it may be better to use mutual funds. These professional managed portfolios contain several stocks. Consider the risk that you are willing and able to take in order to choose mutual funds. Some mutual funds have higher risks than others. For those who are just starting out with investing, it is a good idea to invest in low-risk funds to get familiarized with the market.

You can choose to invest alone if you want to do your research on the companies that you are interested in investing before you make any purchases. Before you purchase any stock, make sure that the price has not increased in recent times. It is not a good idea to buy stock at a lower cost only to have it go up later.

Select Your Investment Vehicle

Once you have made your decision whether to invest with mutual funds or individual stocks you will need an investment vehicle. An investment vehicle is simply another method of managing your money. For example, you could put your money into a bank account and pay monthly interest. You could also establish a brokerage and sell individual stock.

Self-directed IRAs (Individual Retirement accounts) are also possible. This allows you to directly invest in stocks. The Self-DirectedIRAs work in the same manner as 401Ks but you have full control over the amount you contribute.

Selecting the right investment vehicle depends on your needs. Do you want to diversify your portfolio, or would you like to concentrate on a few specific stocks? Are you seeking stability or growth? How comfortable do you feel managing your own finances?

All investors should have access information about their accounts, according to the IRS. To learn more about this requirement, visit www.irs.gov/investor/pubs/instructionsforindividualinvestors/index.html#id235800.

Calculate How Much Money Should be Invested

The first step in investing is to decide how much income you would like to put aside. You have the option to set aside 5 percent of your total earnings or up to 100 percent. You can choose the amount that you set aside based on your goals.

It may not be a good idea to put too much money into investments if your goal is to save enough for retirement. However, if your retirement date is within five years you might consider putting 50 percent of the income you earn into investments.

You need to keep in mind that your return on investment will be affected by how much money you invest. Before you decide how much of your income you will invest, consider your long-term financial goals.