Before you trade in options, you should be familiar with the strategies involved. These strategies are commonly called the Long straddle, Selling cash secure puts, Strangle, and Strangle strategies. To make the process more manageable, you can try trading on a demo account. It is a great way to get familiar with the trading platform and learn the basics. Before you decide to invest, you can test different strategies on the demo account.

Long straddle strategy

Long straddle is an easy options spread that has the potential to yield gains in either direction. Traders will purchase both a calls and put options and wait for the implied volatility rise before closing the trade at a profit. This strategy is excellent for beginners. It is simple to grasp, does not require forecasting future prices, and is very risk-free. The long-straddle strategy is great for novice traders.

Sell cash-secured put

You can start options trading by selling cash-secured calls. These options allow you to buy stock at a low price while receiving the premium from the sale of the put. This type is very popular and provides many benefits to beginners in the options trading market. Learn more .... about options trading and how to earn money.

Strangle strategy

The strangle strategy is an option trading strategy that beginners may have heard about. Strangles work in the same way as straddles. However, they are quite different from straddles in several important ways. Strangles consist of buying two options at different strike prices. A call can be bought for 95 cents, and a place for 105. You can also buy multiple options at the exact same strike price in a cross-over. This way, your long position will shrink if the stock prices rise and your short position will increase if they fall.

Calls to buy

Options traders often invest in calls. Options are contracts that grant investors the ability to purchase or sell an asset for a specified time. Options can expire after a period of time that ranges from days to years. As the market is complex, beginners should be careful. Learn about the risks and rewards associated with options trading before you invest.

Selling puts

Selling puts is a great way to get started in options trading. This option lets you make money by selling a security contract, before its price goes up. Put contracts can be sold on stocks or ETFs. Choose a security you are confident in its long-term value. If a stock's price is rising, you can earn money and lose money if it falls below its strike price. A premium will be charged for volatile stocks and ETFs, which means you have higher profits, and less risk.

Exercising your options

It's easy to get confused if you are new to options trading. It's easy. After purchasing an option, your broker sends an exercise notice to the OCC, which oversees all options trades. Your broker then places the shares in your account. If you work with a good broker, this process can be quite quick. If you are looking to make large profits with your options trading, it is important to exercise your options.

FAQ

Should I diversify or keep my portfolio the same?

Diversification is a key ingredient to investing success, according to many people.

Many financial advisors will advise you to spread your risk among different asset classes, so that there is no one security that falls too low.

However, this approach doesn't always work. In fact, it's quite possible to lose more money by spreading your bets around.

As an example, let's say you have $10,000 invested across three asset classes: stocks, commodities and bonds.

Consider a market plunge and each asset loses half its value.

You have $3,500 total remaining. However, if you kept everything together, you'd only have $1750.

In reality, you can lose twice as much money if you put all your eggs in one basket.

It is essential to keep things simple. Don't take on more risks than you can handle.

Do I need to know anything about finance before I start investing?

To make smart financial decisions, you don’t need to have any special knowledge.

All you need is commonsense.

Here are some simple tips to avoid costly mistakes in investing your hard earned cash.

First, be cautious about how much money you borrow.

Don't go into debt just to make more money.

It is important to be aware of the potential risks involved with certain investments.

These include inflation and taxes.

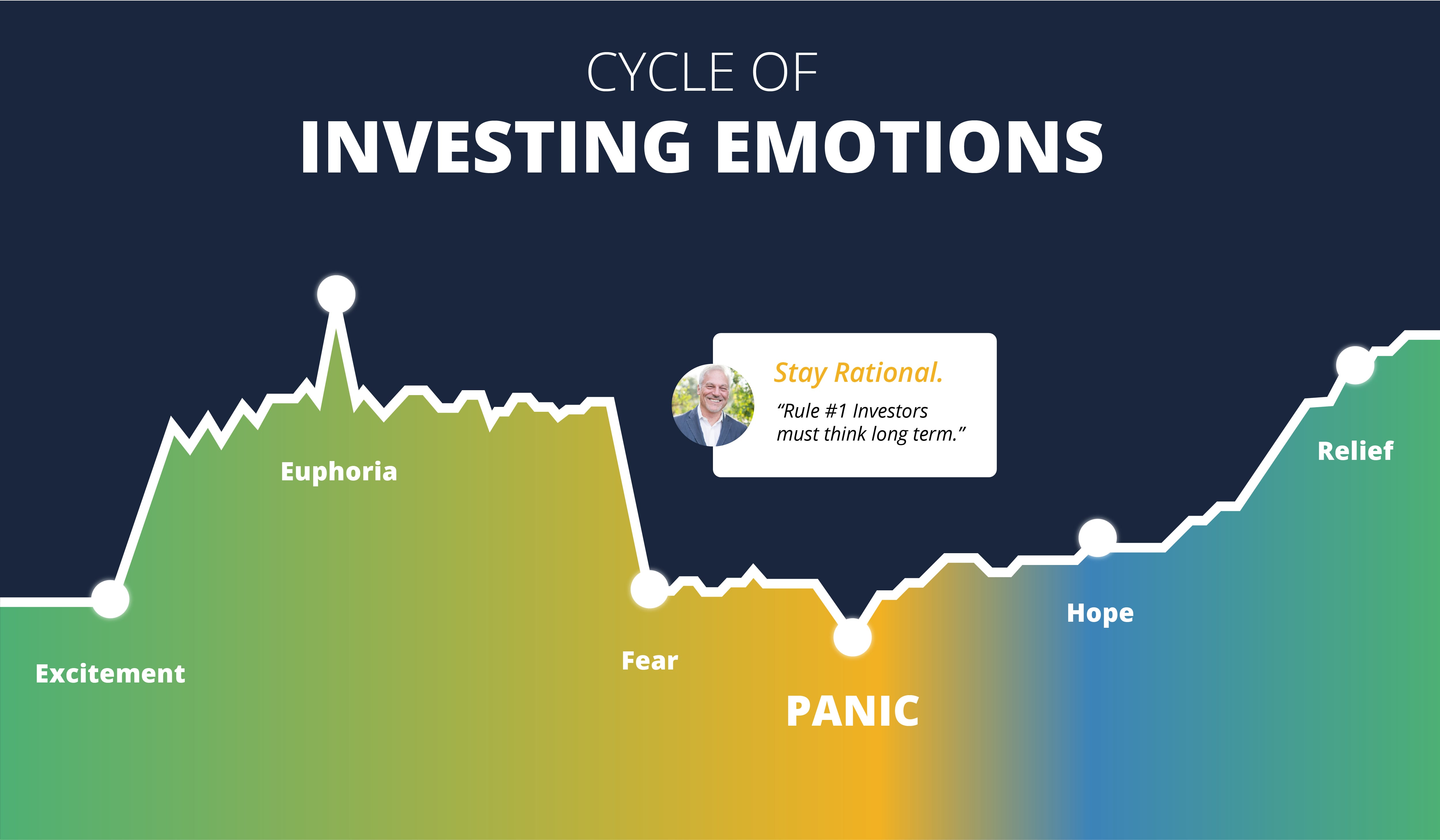

Finally, never let emotions cloud your judgment.

Remember, investing isn't gambling. To succeed in investing, you need to have the right skills and be disciplined.

These guidelines are important to follow.

Which investments should I make to grow my money?

You need to have an idea of what you are going to do with the money. It is impossible to expect to make any money if you don't know your purpose.

You also need to focus on generating income from multiple sources. If one source is not working, you can find another.

Money does not come to you by accident. It takes hard work and planning. So plan ahead and put the time in now to reap the rewards later.

What kinds of investments exist?

There are many types of investments today.

These are some of the most well-known:

-

Stocks: Shares of a publicly traded company on a stock-exchange.

-

Bonds - A loan between 2 parties that is secured against future earnings.

-

Real Estate - Property not owned by the owner.

-

Options - These contracts give the buyer the ability, but not obligation, to purchase shares at a set price within a certain period.

-

Commodities-Resources such as oil and gold or silver.

-

Precious metals are gold, silver or platinum.

-

Foreign currencies – Currencies not included in the U.S. dollar

-

Cash - Money which is deposited at banks.

-

Treasury bills - A short-term debt issued and endorsed by the government.

-

Commercial paper - Debt issued by businesses.

-

Mortgages – Individual loans that are made by financial institutions.

-

Mutual Funds – Investment vehicles that pool money from investors to distribute it among different securities.

-

ETFs: Exchange-traded fund - These funds are similar to mutual money, but ETFs don’t have sales commissions.

-

Index funds - An investment fund that tracks the performance of a particular market sector or group of sectors.

-

Leverage - The use of borrowed money to amplify returns.

-

Exchange Traded Funds (ETFs) - Exchange-traded funds are a type of mutual fund that trades on an exchange just like any other security.

These funds have the greatest benefit of diversification.

Diversification means that you can invest in multiple assets, instead of just one.

This protects you against the loss of one investment.

At what age should you start investing?

On average, a person will save $2,000 per annum for retirement. You can save enough money to retire comfortably if you start early. If you wait to start, you may not be able to save enough for your retirement.

You need to save as much as possible while you're working -- and then continue saving after you stop working.

The earlier you begin, the sooner your goals will be achieved.

Consider putting aside 10% from every bonus or paycheck when you start saving. You might also consider investing in employer-based plans, such as 401 (k)s.

Contribute at least enough to cover your expenses. After that, you can increase your contribution amount.

What are the best investments for beginners?

Beginner investors should start by investing in themselves. They need to learn how money can be managed. Learn how to prepare for retirement. Learn how budgeting works. Learn how to research stocks. Learn how financial statements can be read. Learn how to avoid scams. Learn how to make sound decisions. Learn how to diversify. How to protect yourself against inflation Learn how to live within ones means. How to make wise investments. Learn how to have fun while doing all this. It will amaze you at the things you can do when you have control over your finances.

Do you think it makes sense to invest in gold or silver?

Since ancient times gold has been in existence. It has remained a stable currency throughout history.

As with all commodities, gold prices change over time. If the price increases, you will earn a profit. A loss will occur if the price goes down.

It all boils down to timing, no matter how you decide whether or not to invest.

Statistics

- They charge a small fee for portfolio management, generally around 0.25% of your account balance. (nerdwallet.com)

- As a general rule of thumb, you want to aim to invest a total of 10% to 15% of your income each year for retirement — your employer match counts toward that goal. (nerdwallet.com)

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

External Links

How To

How to Invest in Bonds

Bonds are one of the best ways to save money or build wealth. When deciding whether to invest in bonds, there are many things you need to consider.

You should generally invest in bonds to ensure financial security for your retirement. Bonds offer higher returns than stocks, so you may choose to invest in them. Bonds are a better option than savings or CDs for earning interest at a fixed rate.

If you have extra cash, you may want to buy bonds with longer maturities. These are the lengths of time that the bond will mature. Longer maturity periods mean lower monthly payments, but they also allow investors to earn more interest overall.

There are three types available for bonds: Treasury bills (corporate), municipal, and corporate bonds. The U.S. government issues short-term instruments called Treasuries Bills. They pay low interest rates and mature quickly, typically in less than a year. Large companies, such as Exxon Mobil Corporation or General Motors, often issue corporate bonds. These securities usually yield higher yields then Treasury bills. Municipal bonds are issued in states, cities and counties by school districts, water authorities and other localities. They usually have slightly higher yields than corporate bond.

Consider looking for bonds with credit ratings. These ratings indicate the probability of a bond default. Investments in bonds with high ratings are considered safer than those with lower ratings. Diversifying your portfolio into different asset classes is the best way to prevent losing money in market fluctuations. This helps prevent any investment from falling into disfavour.